What defines a bad REIT?

REITs Good Or Bad to Investors?

The complex structure and tax treatment of Real Estate Investment Trusts (REITs) has mostly shielded them from activist investor scrutiny for vast majority of 40 years. Often seen as more trouble than they’re worth, REITs have mostly flown under activists’ radar thanks in order to organizational and regulatory protections, and the fact that activist investors happen to be occupied by high profile pursuits in other market sectors. Nevertheless, the tide has started to turn against the REIT business, as activist investors have started to aggressively probe and go after REITs, both large and small. The resulting disruptions have pressured REIT industry leaders to reexamine their traditionally reactionary stance in the direction of rogue investors, resulting in proactive countermeasures being developed and used industry-wide.

REITs have historically avoided activist interest due to 3 main factors: 1) a complex structure and set of tax treatments which are unfamiliar to most investors, 2) a large number associated with REITs incorporated in Maryland, a corporate transaction friendly jurisdiction, and 3) a near universally adopted cap on ownership for just about any one shareholder. The maximum ownership provision is the most important the main equation, and generally limits an individual shareholder’s maximum stake in a investment trust to under 10% (9. 8% is industry regular), effectively limiting the amount of sway any single shareholder can wield at any time. Since activist investors deal in influence more than anything otherwise, being limited to a 10% or less share of a investment trust has largely dissuaded them from the REIT industry.

Often viewed as more trouble than they are worth, REITs have mostly flown under activists’ radar because of organizational and regulatory protections.

With a large number of REITs in the past trading below their Net Asset Value, have produced an uptick within outsider interest.

Industry and corporate governance experts reaffirm the attempt by REITs at creating more deliberate communication with investors like a wise proposition.

The Good, The Bad And The Maybe?

This is a new series covering higher yielding Investment Trusts (“REITs”) starting with mortgage REITs (“mREITs”), hitting the majority of the highlights and key factors when evaluating mREITs. I am not going to get involved with all the nuances of these large and complex financial establishments, but rather leave the heavy lifting to the more set up contributors on SA including Brad Thomas and David White, with various links to articles that offer a more in-depth analysis of the companies I review.

Being an investor I prefer to maximize income and capital gains along with minimal taxation. Regulated Investment Companies (“RICs”) were made to avoid double taxation, using the “conduit theory, ” where funds gains, dividends and interest are passed onto shareholders avoiding taxation at the corporate level but have to distribute at least 90% of interest, dividends, and gains gained on investments. RICs are required to distribute 98% of net investment income to prevent paying a 4% excise tax.

There are three types of RICs which i follow and invest in: REITs that invest in real property through properties or mortgages, Business Development Companies (“BDCs”) purchase small and mid-sized businesses, and Master Limited Partnerships (“MLPs”) purchase natural resources, real estate and commodities. Perhaps the name “BDC Buzz” isn’t appropriate and should be something like “RIC Buzz”.

REITs were created by Congress to give smaller investors a chance to directly participate in the higher returns generated by real estate properties which range from office and apartment buildings, to hospitals, shopping centers, and resorts. Currently, the top 35 dividend yielding REITs average around 9% yearly plus an average annual NAV growth of approximately 15% during the last 12 months. Most of the companies that pay higher dividends are mortgage REITs that not own actual properties but invest and own property mortgages and sometimes are considered riskier for their increased exposure to interest rates.

I chose to begin the process by looking over some research that I commenced earlier this season, specifically I decided to select a few articles that I’d written in Q1 and Q2 where I had BUY or even SELL recommendations. Keep in mind that although I had a BUY about the company does not necessarily mean that I purchased shares about the publication date.

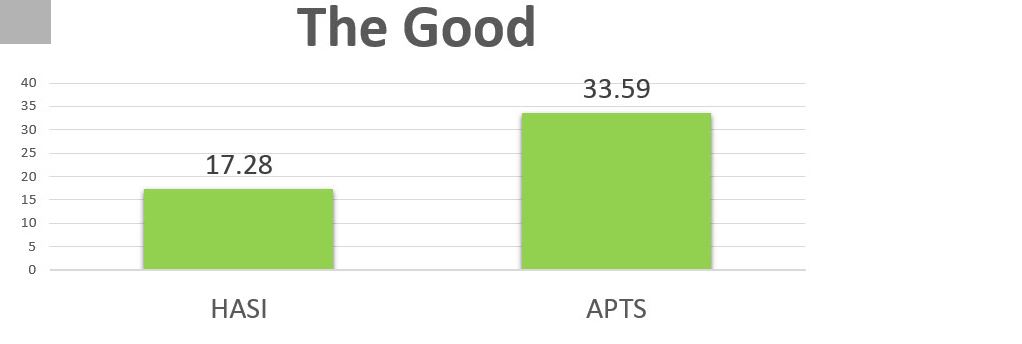

So after closely examining the list of articles I produced the report below which i call “The Good, The Bad, and The Ugly List”.

Basically, I have selected a few REITs that I deem “good” simply because they were my top performers so far this year. The next bucket may be the “bad” list in which I recommended the companies and then your share prices tanked. Finally, I have included the “ugly” bucket or the REITs which i warned you about and hopefully saved you from the deficits.

Let’s start with the Ugly List: Earlier this year I wrote on Wheeler Property (WHLR), VEREIT (VER), and Northstar Financial (NRF) – see article HERE. All three of those REITs got creamed in 2015 and thankfully I provided you with advance warning that steered you from loss of principal.

Now let’s examine the Bad List: Earlier this season I suggested that these REITs would perform well in 2015 based on my fundamentals research. Unfortunately, Mr. Market did not agree beside me. However, ultimately the laws of nature suggests that what falls, must also go up.

Recognizing the mis-pricing I became a bigger shareholder in CorEnergy (CORR), STAG Industrial (STAG), as well as Lexington Realty (LXP). Because of elevated risks the dividend yields for these three REITs became a lot more attractive and recognizing that the dividend was safe allowed me to achieve more confidence in my investment strategies.

Finally, I’ll show a person my Good List: Preferred Apartment Communities (APT) and Hannon Armstrong (HASI) were my best picks to date in 2015. I did not decide to take a position in the company until yesterday but as possible see below, both REITs have performed well since my initial article earlier this season.

Hopefully the “bad” guys will soon become “good” guys and I’ll certainly keep you informed on the way. I do believe that STAG, CORR, and LXP offer promising catalysts which should drive shareholder value through 2015 and 2016. As always, thanks for the opportunity to be of service.

Is really a REIT Right For Me?

Given the background on REITs a question you might be wondering whether investing in a REIT is right for a person. To answer that question, you’ll need to consider your individual situation.

With the requirement to pass on 90 percent of earnings as dividends this makes REITs a somewhat obvious consideration for those looking to create a dividend income stream as part of a multiple income stream strategy. This can be good for someone attempting to generate some income during retirement in a low interest price environment.

The other consideration to keep in mind is if real estate investing is something you need to pursue. Assuming that actual physical ownership presents either too high of the barrier of entry or you’d rather not deal with a few of the other aspects then REITs offer a justifiable alternative. If a person handle it wisely, and it fits your needs, then REITs could be a great part of an overall investment strategy geared towards prosperity production and preservation.

The other thing to keep in mind in relation to REITs is their performance versus the S&P 500. As is visible in the two graphs below, REITs tend to stay on par using the S&P, especially when taken out further in the range of 10 years or more. In some cases the S&P does outperform REITs in general, but generally within a range of 2 percent.

That stated, REITs have considerably underperformed the major indices in the short run in the last few years due to the sweeping bull market.

There will generally be more fluctuation found in the S&P and other indices and that needs to be measured against the heavy dividend income production of REITs. As is visible in the graph from Fidelity, dividends represent about two thirds of REIT total returns with time.

REITs and Your Taxes

The fact that REITs are required to return 90 percent of their income as dividends can make for a surprise come tax season if you’re not prepared for this as it’ll generally account as ordinary income.

The other taxation issue to consider with REITs is that REITs are subject to local lawmakers for property taxes. If a state or municipality decides to raise property taxes then that’s going to impact REIT holders as it’ll decrease the total amount in dividends they’ll receive. While tax planning is possible to help mitigate the first tax implication of REITs the second will probably be more difficult to manage.

This is not to say that REITs are bad to hold from a tax perspective. It just needs to be done wisely. One relatively simple way to help mitigate the tax impact would be to hold REITs in a non-taxable account such as an IRA instead of a taxable brokerage account as that can help shelter high of the tax hit one might face from receiving dividends. (Observe: Practice Tax Location to Boost Investment Returns).

Risks Related to REITs

As with any investment product, REITs are not without having risk. The first, and one of the more obvious risks of purchasing REITs is that it’s traded like a stock, which means it may lose value. While REITs have more upside than traditional set income products, the associated higher risk must be considered when taking a look at REITs as a pure dividend product. They will fluctuate in value in the future, just as a stock does, so that must be regarded as.

Other risks of REITs are as follows:

They must contend with other high yield investments. As interest rates rise and high-yield [investment opportunities arise] REITs must contend with those. More options may cause lower demand, which could reduce REIT stock prices.

Property taxes: As mentioned previously, REITs are subject to lawmakers. If a municipality decides to raise property taxes after that that’ll negatively impact dividends.

Rising interest rate climate: The present rate climate has made REITs attractive, to a certain degree. But as interest rates rise, other sources of yield may begin to look more attractive from a risk-return perspective, which might bring increased pressure to REIT prices..

Loss of property: An additional risk REIT owners face is downturn from niche markets. Having a broad based approach is one method to help mitigate this risk.

Each of these situations presents a unique risk to REITs in that they’ll directly impact the dividend production investors are reliant on. This doesn’t make REITs bad investments. It just requires you to consider the associated risks and know how they might impact you – just as you were investing directly in physical real estate.

Balance is Key

As with any investing, balance is key. That is no different when it comes to REITs as an investment option. There are various things to consider from what your overall goal is to where you stand at in life.

Yes, there are risks associated with investing in REITs but there’s also some upsides that are somewhat unique in the investment globe. If you’re wanting to create a passive stream of income through dividends or are wanting use of real estate investing without actual physical holding of it then REITs could be a good part of a well-balanced portfolio. Even if neither of these situations are the case for your particular situation they can still bring some necessary diversification in certain circumstances.

The key, as is with anything associated with your wealth accumulation, is staying on top of your opportunities. There are various factors which can impact return that have to be watched over on a semi-regular basis, which is where Personal Capital will help you stay on track with your investing goals.