Norwegian REITs is that a thing?

REIts Marketplace sizes Norway

GPFG(Norwegian Government Pension Fund Global)

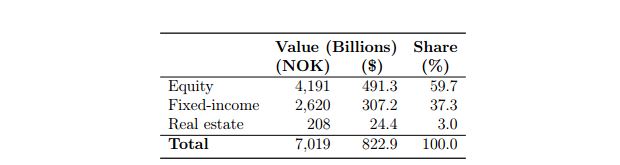

The Norwegian Government Pension Fund Global (GPFG) was setup in 1990 to manage petroleum revenues on behalf of the actual Norwegian people. It is now the world’s largest sovereign-wealth account, with assets under management of 7. 019 trillion Norwegian kroner ($822. 9 million) on September 30, 2015. The Fund was first opened to real-estate investment (both listed and unlisted, and including property derivatives), up to a limit of 5% of property, in March 2010, and the first unlisted real estate investment was produced in April 2011. As of September 30, 2015, real estate symbolized 3. 0% of the Fund’s portfolio, mostly focused on core markets in Europe and also the U. S. The overall breakdown is shown in Table 1.

Table 1: Market worth of Government Pension Fund Global (GPFG) on Sept 30, 2015. Source: http://www.nbim.no/en/the-fund/market-value/key-figures/. Dollar values calculated using the Sept 30, 2015 exchange rate of 8. 53 NOK/$ (supply: Datastream).

Despite this growth, both the target allocation as well as invested amount lag well behind other institutional investors. For instance, in their survey of 231 institutional investors in 28 nations, Funk, Weill, and Hodes (2014) report an average target allocation to property of 9. 38% in 2014 (up 49 bps through 2013), with an intention to increase this to 9. 62% throughout

2015. The average fraction actually invested is only slightly reduce, at 8. 49%. Preqin (2015a) reports average present allocation to infrastructure for investors has increased from 3. 5% associated with AUM in 2011 to 4. 3% in 2014 and 2015. Target allocations towards the asset class have continued to grow in 2015 and right now stand at 6. 3% of AUM for those investors allocating towards the asset class. Allocations are likely to continue to grow within the coming years, with 44% of investors planning to increase the quantity of capital they invest in infrastructure.

Investing in private REITs and infrastructure – Norway

Besides investing in listed real estate (possibly REITs or shares in real-estate companies), another way to achieve exposure to real estate is via private equity investment, which could take the form of direct investment, investment in unlisted money, or investment in a fund-of-funds vehicle. In addition to deciding how much of a portfolio to purchase real estate, GPFG therefore also needs to consider how that allocation ought to be split between private and public real estate.

Estimates differ (observe Section 3), but while listed real estate holdings tend to be significant, the “average” investor has 75-85% of its real property holdings in private investments.

Of course, to fully address the actual public/private split for GPFG, we need to compare the return characteristics of private versus public property, and also to take into account the specific features from the Fund that might make it more suitable than the typical investor to invest in either public or private real property.

The standard series used to study private and listed property returns are the NAREIT REIT index (listed) and also the NCREIF appraisal-based index (private). Before drawing any definitive conclusions from comparisons of those indices, it is important to note that there are some significant data issues that affect this comparison. In particular-

1. While we can notice daily, transaction-based prices for REITs, privately held real estate deals infrequently. As a result, the NCREIF index is based upon appraised prices, which tend to exhibit significant smoothing, serial relationship, and lags relative to REIT returns (see, for instance, Geltner, 1991, 1993; Ross and Zisler, 1991).

2. Whilst NCREIF returns are unlevered, REIT returns are calculated for levered equities.

3. The mixture of property types may differ between the two indices.

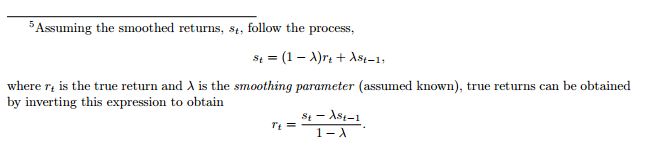

A sizable literature has attempted to control for some or many of these issues. Geltner (1991, 1993) and Ross and Zisler (1991) first showed how you can correct for smoothing of prices, 5 and their work may be extended by others, including Shepard, Liu, and Dai (2014), that use Bayesian methods to explicitly handle uncertainty and time-variation within Geltner’s smoothing parameter, λ, as well as correcting for leverage and also the differences between property types in the respective indices.

Along with these data issues, another big difference between direct and roundabout investment in real estate is that REIT shares, like closed-end money, often trade at prices quite different from their net resource value (NAV).

This premium (or discount) displays the capitalized benefits of the REIT over holding the property directly (e. g., liquidity, managerial ability,

taxes, funding benefits, lower management costs) minus costs (e. g., administration fees, agency costs). 6 Figure 7 shows the typical REIT premium from 1990-2015, obtained from Green Street’s Web website on October 6, 2015. Over this period, REIT shares possess traded as low as 40% below NAV and as higher as 30% above NAV, so there is a fair level of variability in the level of the premium (or discount) with time.